This should be a lay-up. Let me try to convince you.

Business Description:

Malaga started in 1985 as Malaga Savings & Loan and is headquartered at 2514 Via Tejon, Palos Verdes Estates, CA. The bank started when a couple of doctors, a dentist, a local construction CEO, and a CEO of a tamper-evident shrink film manufacturer came together to form a savings & loan bank with a focus on local 1-4 multifamily lending. Presumably, they wanted a bank that would serve individuals like themselves with enough money for a real estate business, but the relationship wasn’t large enough to be served by larger banks.

In 2004, the company re-chartered to become Malaga Federal Savings Bank, wholly-owned by Magala Financial Corporation (the bank holding company that is publicly traded).

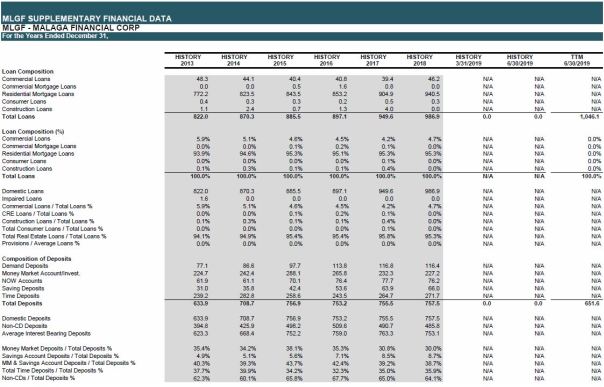

Presently, Malaga has stayed true to the original premise, with mortgages representing more than 95% of the approximately $1.05 billion of loans. The bank’s 1-4 multifamily and single family loans represented 83.0% and 12.3% of total loans, respectively, at the end of 2018. To support the low risk nature of Malaga’s lending strategy, during the Great Financial Crisis (“GFC”), 1-4 multifamily buildings in Los Angeles generally transacted at cap rates of 6%-8%, when long-term rates were in the 4%-5% range. Since 1-4 multifamily non-owner-occupied mortgages generally require 25% down, very few of Malaga’s loans would move towards a LTV ratio of >100% in the event of a significant upward yield curve shift, were it to happen. In fact, Malaga would likely predominately benefit from an increase in rates. The bank would likely be isolated from a further decline in rates due to its funding and low efficiency ratio (similar in some ways to HIFS, as I previously outlined).

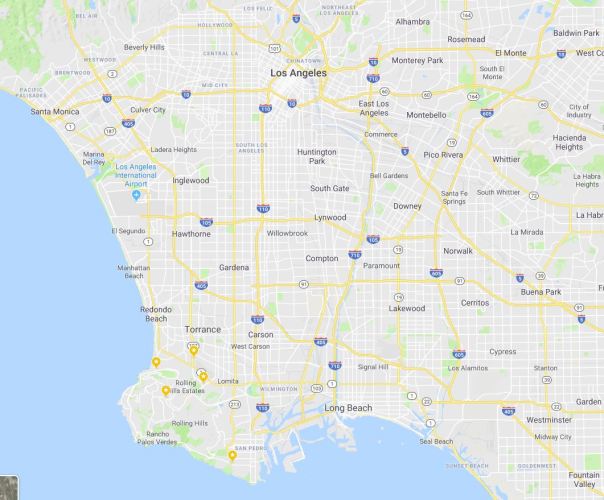

Now we know that the bank is quite conservative in how it lends. However, the best part of the bank is its location. The bank has 5 branches in the Palos Verdes/Rolling Hills, located in the South Bay area of Los Angeles, CA. The Palos Verdes area is a relatively wealthy location in the hills of Los Angeles, near Torrance, CA. In 2017, the median household income, median household net worth, and median property value were $125,000, $250,000, and $1.05 million, respectively. Below is a map of the bank’s branches.

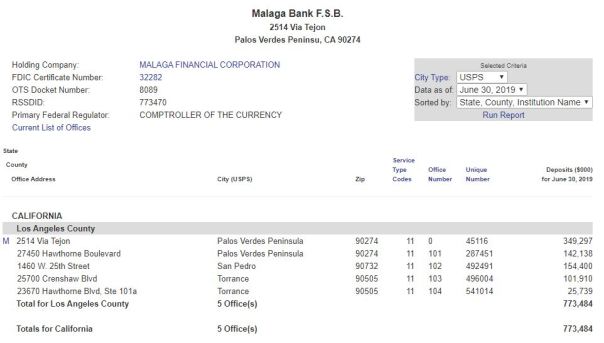

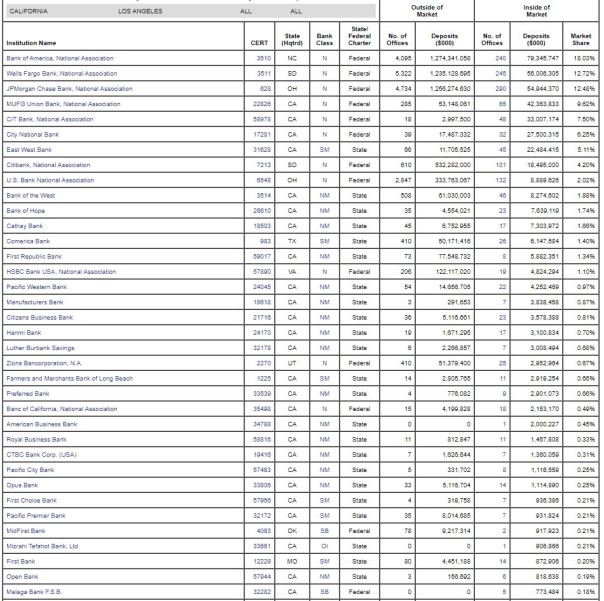

Malaga has a fairly even distribution of deposits, considering the history of the bank. The deposits, by branch, and the bank’s deposit market share in Los Angeles County (as of 9/30/2019) are presented below.

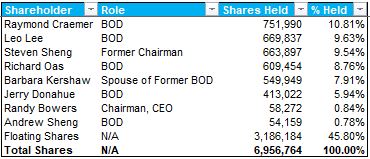

One risk associated with Malaga’s founding and present strategy is that the bank is closely held by its board members and executives. In total, current board members, executives, and spouses of deceased board members own a controlling interest in the Malaga. One of the consequences borne out by this risk is the on-going related party loans to board members and executives, which totaled $10.7 million in 2018. However, related parties paid an interest rate of approximately 4.1% on those loans, which slightly exceeded the banks overall interest rate and was in-line with the bank’s normal lending policies. The bank states that they do not lending at special rates to insiders and I could not find a loan to family members of board members and executives that would contradict that statement. Malaga seems to treat minority shareholders fairly.

Malaga’s most recent proxy statement is included here.

In summary, Malaga is a conservative lending bank operating in a highly desirable location. Malaga is also severely over-capitalized, given the risk absorbed by the bank (as I’ll outline below). Despite the over-capitalization of the bank, Malaga still earns above-average returns on equity while trading near tangible book value (“TBV”). As a result, I believe I can show that Malaga is extraordinarily cheap relative to the bank universe and from an absolute return perspective.

Financial History:

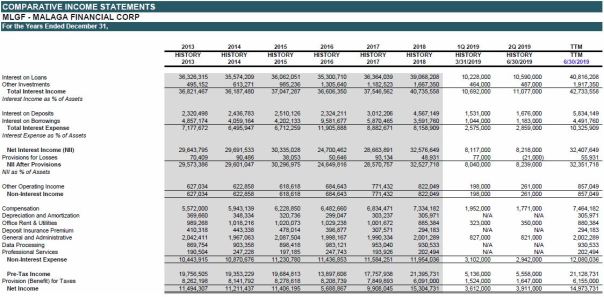

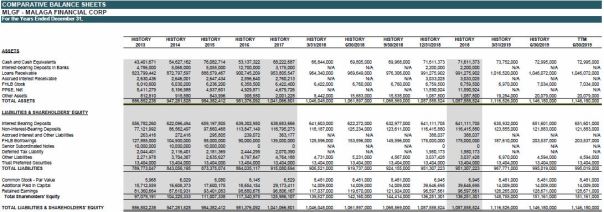

Malaga’s historical financials and other supplemental data are presented below.

Not sure if others have a problem reading these tables, but here are the PDFs:

Historical Financial Summary:

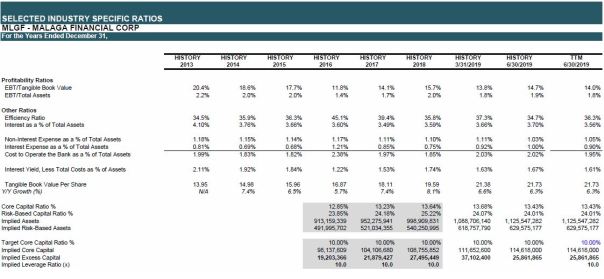

On review of the historical financials, the first thing that jumps out is that Malaga is severely over-capitalized, with a core capital ratio of 13.4% and a risk-based capital ratio of 24.0%. Since Malaga has 95% of its loan portfolio in mortgages, the bank’s 7.6x leverage ratio (total assets / shareholders’ equity), should be closer to 10x to operate efficiently. Despite the over-capitalization, Malaga still earns a 14.0% pre-tax return on TBV and has a 36.3% efficiency ratio.

If Malaga were to increase leverage such that the core capital ratio was 10.0%, Malaga’s net interest income would increase by roughly 32%, the efficiency ratio would decline to approximately 28%, and the pre-tax return on TBV would increase to approximately 21%. Alternatively, if due to regulations or a lack of lending opportunities, Malaga decided to return capital to lower the core capital ratio to 10.0%, Malaga could distribute $25.9 million to shareholders today while resulting in similar operational improvements.

In short, Malaga has an excellent operating location, conservative lending strategy, and the bank has the opportunity to increase returns by 50% over time with simple changes.

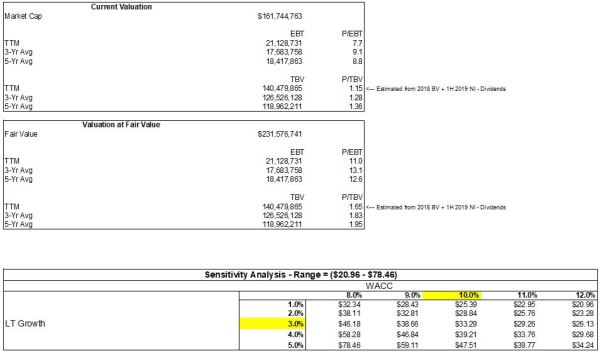

One thing to note is that quarterly financial results are based on the bank’s call reports, which report shareholders’ equity as bank capital. Bank capital exceeds shareholders’ equity by ~$10 million for various reasons. At 6/30/2019, TBV is roughly $20.19 per share (as determined by 2018 TBV + 1H 2019 net income – dividends in 1H 2019). Malaga currently trades for 1.15x TBV (see the DCF slide below).

Valuation Method:

Malaga is a stable bank with simple operations. As such, a DCF is the best valuation method.

As a bank, we should always consider whether they should be viewed as a going-concern (based on the financial health of the company, the ownership of the bank, and the highest-and-best use of the assets). In Malaga’s case, TBV provides downside protection but the bank’s highest-and-best use is as a going-concern. As such, I didn’t focus on book value as a valuation method.

Given the high insider ownership and over-capitalization, it appears unlikely that Malaga would consider selling itself to a larger entity, so I am not presenting transaction comps. Malaga could likely sell itself for 1.7x – 2.0x TBV, based on the size of the bank. Given the location and efficiency ratio, 2.0x TBV would likely be a reasonable exit price for the bank. Since this scenario is unlikely, I didn’t use this as a primary method.

Finally, using comps to determine a fair multiple of earnings would seem to be a better method than a DCF, since bank’s a relative homogeneous and there are plenty of small, publicly-traded banks in California. I decided not to go down this route since I didn’t want to spend a ton of time looking in to what adjustments might be necessary to properly address the differences in Malaga’s location, over-capitalization, and business model. Instead, I choose to do a DCF and add-back the excess capital available to shareholders today.

Valuation:

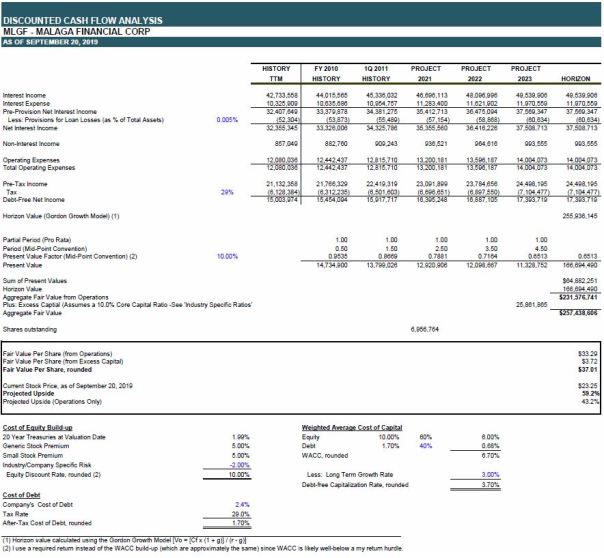

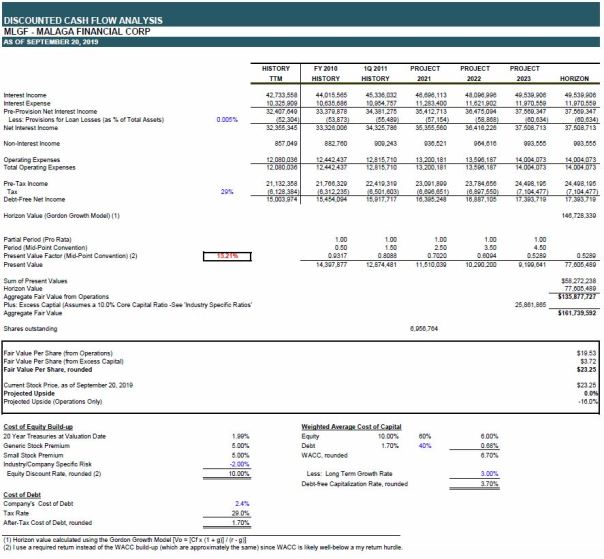

Below is the DCF, based on historical loan loss provisions, a normalized corporate tax rate of 29%, and a discount rate of 10%. As footnoted, the discount rate of 10% was selected as a minimum return hurdle, since the bank cost of capital was calculated to be below such hurdle. The market seems to be requiring a 15.2% return today, as shown in the goal seek version of the DCF. That’s a healthy return given the downside protection!

Approximately 90% of the calculated value ($33.29 per share) is from the operations and 10% ($3.72 per share) is from the bank’s excess capital. The value of the bank would be higher if I projected the utilization of the excess capital through increased leverage over time. I probably should have modeled it out but it would be better if the bank actually increased leverage.

In summary, I calculate Malaga is worth approximately $37 per share today (1.65x TBV), which is in-line with the low end of transaction comps (which assume a control premium not present in this valuation). Always good when the calculated value is reasonable! The growth rate in the sensitivity table roughly models the effect of increased bank leverage (through higher than normal earnings growth for a prolonged period) which is how we arrive at a per share value of roughly $78. Without factoring in drastic capital allocation changes, Malaga is reasonably worth $35-$40 per share.

Liquidity is certainly a factor in the low valuation. When a company is this cheap, worrying about paying 5% above the current mid-point price seems foolish. There is liquidity if you don’t need to purchase at 1.1x TBV.

As always, please do not interpret this article as an investment recommendation. Do your own research and consult your financial advisor before making any investment decisions! I am not your financial advisor.

PDFs: