I like banking because you get to meet your customers on one of the better days in their life, not their worst (like with insurers). They are generally buying a house, a car, or expanding their business. Since the dawn of civilization, a trusted member of society has accepted deposits of goods or specie and effectuated transactions in return ‘for a spread’. There’s something wonderful about the simplicity and necessity of banks.

In this article, I’ll attempt to convince you that the most interesting bank in the US is a small, former mutual savings bank. I want to be the first to detail the enterprise in detail since I believe investors will ultimately conclude that they are something akin to how Warren Buffett would have run a bank, if he had choose banking over insurance. A few have summarized HIFS long history of outperformance, I’ll try to write down the recipe for the secret sauce.

History of HIFS:

One of my favorite parts of researching companies is to learn the story behind them. Where are they located? How do they make money? How do they earn more (or less) than competitors? What are the employees like? The customers? Management?

Sometimes the story of the company doesn’t play a large role on the potential returns of an investment. Consider the Plexure Group thesis that focused on the McDonald’s relationship and failed to rely on historical financial results. Other times, it may be critical. Studying management’s prior decisions and the context they were made in can be the best window a potential investor can possibly get in to the true people behind management.

I think HIFS is one of those companies where the history is instructive for an investor considering the potential range of expected returns going forward. Below is a short timeline of HIFS operating history since going public.

1988: HIFS, which operated as a mutual savings bank since 1834, completed its conversion to stock form on December 20, 1988. Former MA state banking commissioner Paul Bulman was the first CEO. Prior to taking the job, he declared in 1987 that the “state’s [MA’s] banks have never been safer”. Obviously you are reading this quote because the banks were not safe.

NOTE: Annual report in the links. I’m glad HIFS hosts all of these on their site, it’s a great resource to have all of company’s annual reports be easily accessible.

1989: Come to find out, MA banks are not safe. In Bulman’s first year, HIFS recorded a $2.85m pre-tax loss due to a $3.5m provision for loan losses. The $2.4m net loss in 1989 represented 11.6% of shareholder’s equity at 12/31/1988.

1990: The S&L Crisis has morphed in to a classic bank panic. By some miracle, HIFS has managed to grow deposits slightly but shareholder’s equity fell 23.6% to just $13.75m. Since becoming a bank two years prior, HIFS’ shareholder equity contracted 33.7%. If HIFS wasn’t over-capitalized at conversion, they would have been skunked by now.

As a result, HIFS adds three outside directors to the board, including a local lawyer at Gaughen, Gaughen & Gaughen, Robert Gaughen Jr, the current CEO/Chairman.

1991: The bank managed to shift the portfolio from local residential real estate loans to MBS securities. It is incredible in hindsight how close HIFS was to becoming illiquid in 1990-1991. In 1990, HIFS had $10.1m in REO and losses were surging. HIFS was one small run on the bank away from the FDIC seizing control.

1992: The potential of the bank begins to become apparent. Pre-tax ROE, less net foreclosed property expenses, is greater than 20%. The bank’s portfolio is structured approximately 50/50 loans/MBS.

The CEO’s father joins the board. It foreshadows the Gaughen takeover of the bank.

1993: Robert H. Gaughen Jr. notifies the bank he plans to nominate a slate of nominees to the BOD. HIFS sues Robert H. Gaughen Jr. Robert H. Gaughen Jr. counter-sues for breach of fiduciary duty. The vote is challenged but ultimately allowed to occur and Robert H. Gaughen Jr. is successful in his ascent to CEO.

By the end of 1993, NPAs decline from $9.4m to $2.7m. The bank begins to originate loans again, with a 20% y/y increase to $30.8m in originations in 1993 ($23.5m of the originations occurring in the 2H 1993). EBT (ex-special expenses) is ~$2.4m on shareholder’s equity of $14m. The Gaughen Era has begun.

1995: The culture of the Gaughen-led bank begins to shine. Starting in 1994, pictures of employees are included at the outset of the report. In 1995, the traditional President’s Message is followed by the bank’s “Primary Assets”, which includes pictures of employees at each of the branches. It’s a nice touch.

HIFS has successfully escaped the S&L Crisis, led by Robert Gaughen Jr., and the future looks bright. Let’s skip a decade or so and get to the next exciting period.

2006: For those around long enough to remember, this is the beginning of something different in the financial markets, though no one has any idea the cliff the U.S. economy is hurtling towards. Despite double-digit volume growth, the yield curve shifted to a yield line (very much a vertical shift from today’s yield curve). As has become standard, HIFS comes right out and tells you why things are bad (but generally only hints at the ingredients of their secret sauce).

As I’ll detail later, HIFS has a model that can sustain most financial shocks due to an efficient operating model, above-average loan origination ability (quality and volume), and a location with secular growth trends in both population and wealth, with just-the-right image to match the area. The downside is HIFS is dependent on market funding to allow for the organic growth that has made them a fortune. At times, like 2006 and today, a flat yield curve can hamper the bank’s ability to generate returns up to their potential.

2006 and 2007 represent the only time in the Gaughen Era of the bank that HIFS earned less than 10% return on equity. HIFS has been profitable in every year since 1993.

2009 and 2010: From the lows of 2007, earnings more than doubled through 2010 and HIFS first eclipsed $1 billion in assets. The bank’s high-quality lending reputation was indeed accurate. Throughout the global financial crisis (“GFC”), impaired loans reached its zenith in 2009 at ~1.5% of total loans outstanding. By way of reference, a little more than 2% of prime mortgages defaulted in 2009.

2012 (you have to start downloading the annual reports at this point): Patrick Gaughen, the current President and COO and [likely] future CEO of HIFS, is hired by the company and elected to the BOD.

2012-Present: I will review the bank’s financial performance below so here I will focus on the qualitative. The qualitative changes made by the bank over the last several years include:

- The prioritization of improving and/or upgrading the bank’s IT systems. In a story told at the 2019 annual meeting, HIFS first realized they needed to upgrade their IT systems because the largest depositor at the bank, an elderly man, suggested adding mobile check capture capabilites so that he wouldn’t need to visit a branch so often. HIFS seems to focus on their advanced technology offerings, especially relative to the size of their bank, with displays such as their uptime tracker.

- As previously discussed, HIFS added a Washington D.C. lending office based on an internal analysis that suggested the D.C. market’s 1-4 family and apartment building market was similar to Boston’s and an ideal expansion area for the quickly growing bank.

- An effort to reduce the bank’s reliance on fee income (primarily through service fees on deposit accounts). HIFS’ management feels strongly that the only sustainable bank model, especially for community banks, is one that doesn’t rely on fee income or trust income to earn outsized returns (startlingly different than the bank model I was taught to appreciate, but I’m coming around to their view after researching HIFS). Despite a doubling of deposits since 2010, service fee income is down approximately 20% during the period.

- Due to the bank’s legacy charter from their savings bank conversion, as detailed previously, HIFS is able and has finally begun investing in individual publicly-traded equity securities. At 3/31/2019, the bank held $34.8m of equities, or 15.7% of shareholder’s equity. This is the highest ratio of any publicly-traded bank in the country, other than related bank holdings at Southern BancShares (SBNC).

The change in accounting standards that require unrealized gains/losses to be reported on the income statement will likely make HIFS (and SBNC’s) financials more volatile than they actually are. This may provide some opportunities to buy HIFS at a momentary discount due to the small float, low market cap, and new accounting standards. Warren Buffett and Charlie Munger recently focused on this issue at the Berkshire Hathaway annual meeting.

Although it has taken me some time to appreciate the method to their madness, I think I can finally see the logic behind low fees, a focus on 1-4 family and apartment building lending (due to a slight premium in interest relative to mortgages and a steady demand for the underlying space being rented [people always need to live somewhere]), a low-cost loan origination model vs. a high-touch/low-cost of funding model with asset management/trust income-focused banks (as pushed by WEB a la WFC and me with CNND).

An additional focus of the bank that may prove fruitful going forward is management’s attention on small-and-mid-sized (“SMID”) business relationships. HIFS created a specialized deposit team with the goal of improving funding relationships. HIFS is not unique among banks, large or small, in seeking out low cost funding given the current yield curve. What is different is it seems to be working, with non-interest bearing deposit CAGR of 17% from 2014 through the 1Q 2019. If HIFS can lower their core funding costs then normalized NIM (if there is such a thing) may be higher than previously witnessed. Further, the opportunity cost on the SMID relationships is minimal since HIFS already has very low fees per $1 of deposits.

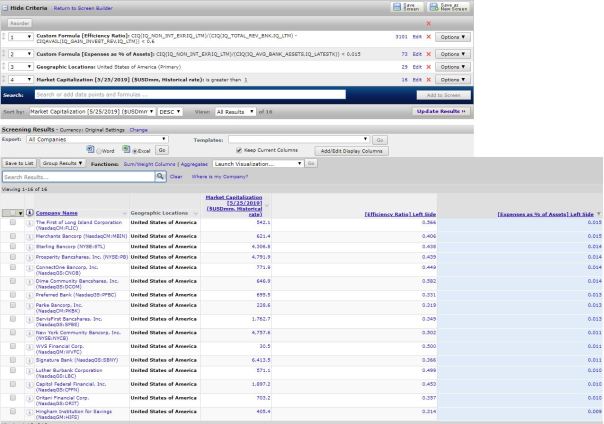

HIFS has taken the low-cost, GEICO-like (well, Progressive-like (PGR), but GEICO’s cost advantage is better known) banking model to an extreme. In 2018, HIFS efficiency ratio was 29.9% (excluding unrealized equity gains/losses), more than 700 basis points (“bps”) below the more infamous Bank OZK (OZK). Further, it cost HIFS approximately 0.82% or 82 bps as a percentage of total assets to operate the bank. All-in annual non-interest expenses for HIFS reached 2.01% as a percentage of total assets in 2018. Best I can tell, outside of single-branch banks, HIFS is the most efficient publicly-traded bank in the U.S.

There are 16 publicly-traded banks in the U.S. with an efficiency rate of less than 60% and expenses as a percentage of assets of less than 1.5%. HIFS has a 20 bps advantage in expenses and a 200 bps advantage in their efficiency ratio (HIFS adj efficiency ratio is 29.9%).

HIFS Financial Summary:

It’s rare I will do a deep dive on a company’s history such as I have with HIFS here. As mentioned, I think the totality of the history is instructive in making the point that HIFS is different. They are not lucky, they are not momentarily or temporarily benefiting from a particularly well-suited yield curve or economic conditions. Assuming that HIFS is able to continue to make decisions in the same manner that they historically have, HIFS will outperform financially. Outside a persistent, negatively-slopped yield curve or a sudden decline in loan origination quality coupled with an economic downturn, I’m not sure what can permanently hurt HIFS.

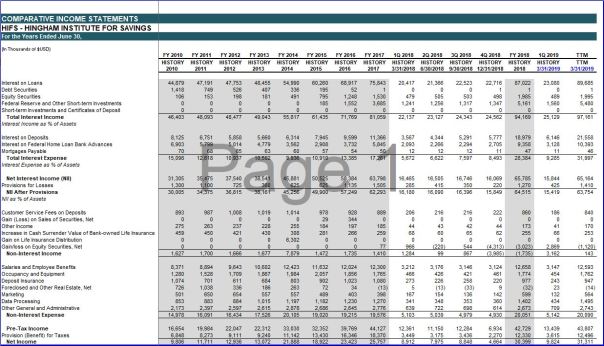

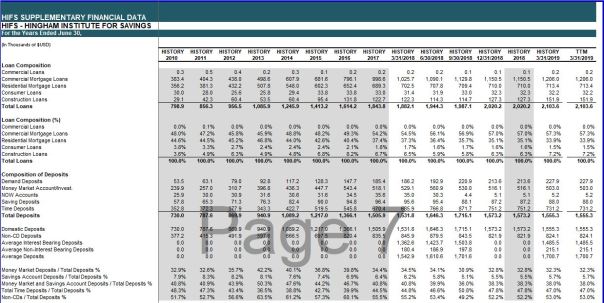

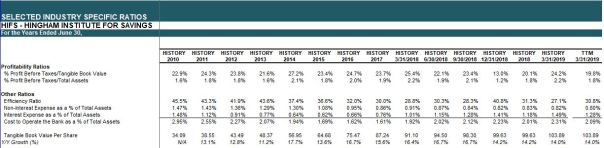

Much of this is a re-hash of what I’ve previously provided so I won’t focus on explaining what you can see in the above tables.

HIFS Financial Statements and Other Ratios, from 2010 – 3/31/2019:

HIFS Valuation:

When considering how to value HIFS, we have the following options: (1) the asset method (a book value analysis); (2) a market-based method (guideline companies and/or transaction comps); or (3) earnings method (a simple capitalization/multiple or earnings and/or a DCF).

While it seems like book value is the way to go with a bank, in HIFS case, I suspect they will continue to operate. Thus, I suspect they are worth more as a going concern. As such, I will not provide a liquidation valuation.

Due to some of the reasons I discussed previously, including HIFS’: (1) ability to hold equity securities with a bank charter; (2) operational efficiency relative to peers; (3) quality lending practices; (4) ideal geographical location; and (5) IT advantage relative to competitors (local and domestic), especially given their size, I don’t think a guideline company analysis (relative valuation of comps) is all that instructive.

I also don’t think a transaction analysis is indicative of value because I believe it is highly unlikely HIFS would sell itself to another bank. If we know HIFS will only be valued on a minority basis then there is no sense falsely raising our hopes by checking what a controlling basis value might be.

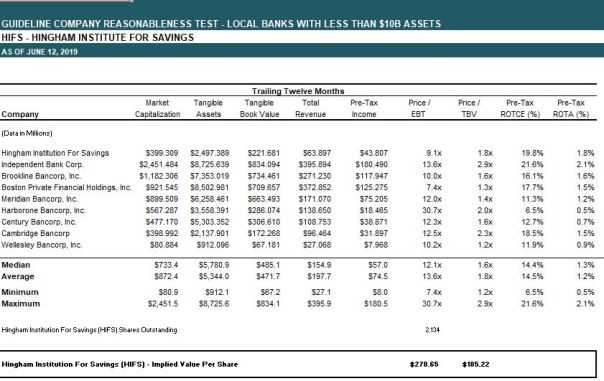

For reference, here is a brief guideline company analysis based on Boston-area banks and nationwide transactions. Again, I don’t think either method is a good indication of value but at least you know I did it and it suggests HIFS is roughly fairly valued to slightly undervalued.

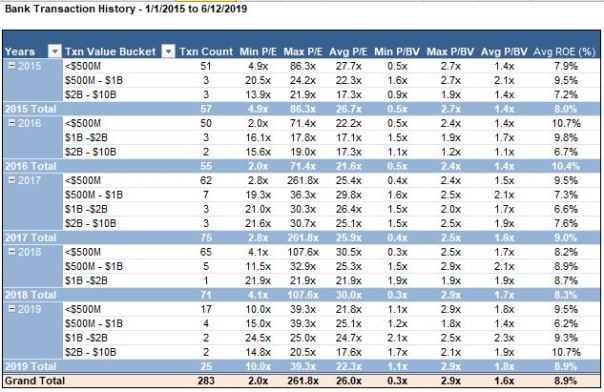

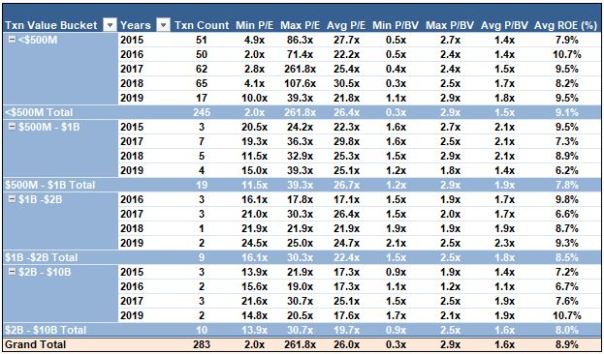

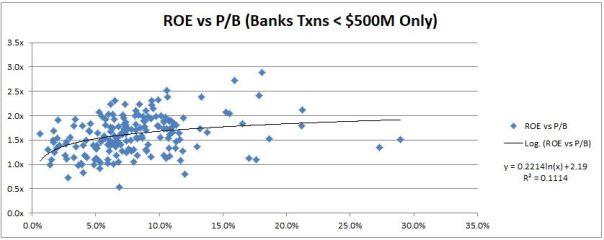

These charts for bank transactions use identical data presented in a slightly different way. I also wanted to test if a premium was paid for banks with higher ROE. There is a slight premium paid but it tapers off, likely due to one-time gains and concerns regarding the sustainability of high ROE.

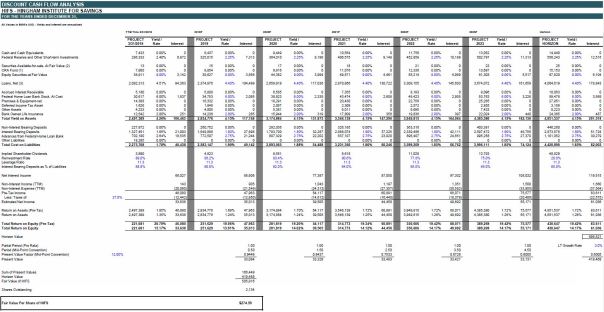

DCF Valuation:

Since HIFS has not engaged in M&A activity, the business model is unchanged, the business is growing above the projected long-term growth rate, and we are reasonably able to determine future cash flows, I went with a DCF valuation as opposed to a multiple/capitalization of historical earnings.

My DCF makes a few assumptions, which are listed below (and, hopefully, presented in blue in the images below).

- HIFS reinvestment rate of 88.3% is assumed to fall towards 75% over the next 5 years and is estimated to be 20% in the horizon period. The 20% reinvestment rate in the horizon period is based on a LT growth rate of 3% and a projected long-run ROE of 14.3%, assuming roughly unchanged yield/rates and asset/liability construction. I’m trying to be conservative here.

- HIFS leverage ratio is unchanged at 11.3x

- HIFS will shift slightly to interest bearing deposits from FHLB Debt, given the expected rate spread.

- The cost of funds will rise slightly and the yield on assets will decline slightly, relative to the TTM period ended 3/31/2019.

- HIFS long-run tax rate will be approximately 27.0%

- A discount rate of 12%. There was no science behind this assumption. It’s something akin to my required rate of return, plus a few bps due to the size of the bank, the cyclicality of banking, less some bps due to the financial and distribution history.

- Non-Interest Income only includes service fee deposits at 0.05% of deposits (you’ll also notice I address BOLI in interest income – I know this is wonky but it worked out easier to model it this way).

- I assume a long-run rate of return on equities of 9% and that individual publicly-traded equities remains at 15.7% of shareholder’s equity.

If the image above is unreadable you can try the following pdf: 01b – DCF

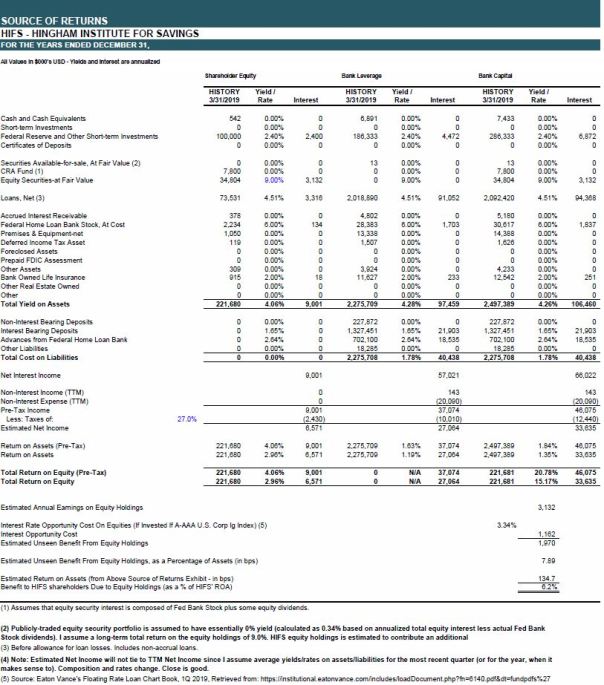

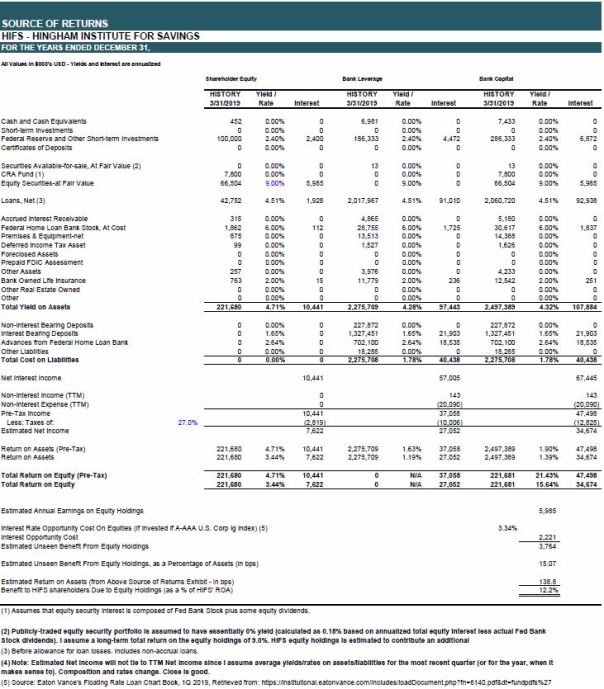

Return Composition:

In addition to HIFS efficiency advantage, their legacy charter allows them to invest in individual equity securities. I believe this additional allocation flexibility will result in further outsized returns over time. If we assume 9% long-term returns, predominately through price appreciation (as alluded to in HIFS Form 10-K), then I arrive at the following unseen advantage that I tried to account for in my DCF above.

Again, here is a pdf link if the above is unreadable: 02 – Return Composition.

I’m not sure how reasonable it is to separate the bank into shareholder’s equity and bank leverage, but this is my effort to rip them apart and put them back together. I’ve come up with crazier ways to analyze a stock before.

The 6.2% increase in ROA / ROE is due to HIFS decision to forego interest on high-grade corporate or municipal bonds, in favor of unrealized capital appreciation of equity securities.

I would imagine HIFS will be unable to allocate more than 25% – 30% of shareholder’s equity to individual equity securities at any point in the future but the allocation has reached as high as nearly 20% recently. This has previously been an undiscussed nuance of HIFS’ outperformance. Below is the boost to HIFS’ returns if equity allocation reached 30% of shareholder’s equity.

Conclusion:

One thing I didn’t include above is the usual sensitivity tables and a deeper dive in to the various outcomes of the bank. For one, I don’t think I can add value to readers by projecting future net interest margin (“NIM”) spreads. I also think a continued NIM spread contraction, held in perpetuity, based on the presently flat yield curve is a historically conservative estimate. Whether the yield curve actually experiences some lift in the future and whether yields (or inflation) ever rise at some point in the future is anyone’s guess, but it should only improve an investment outcome in HIFS. Thus, the above estimate of value of approximately $275 per share seems reasonable to me. That is to say, in general I think HIFS is undervalued, but my confidence interval is likely wide and includes today’s price ($188.00 on 6/19/2019).

In my opinion, HIFS bank model is built to generate 10%+ and, at times, 15%+ returns on equity. In certain rate environments, I could imagine HIFS generating returns of more than 20% for short periods of time. This seems especially if they continue to expand their SMID relationships and increase the proportion of non-interest bearing deposits as a percentage of total funding. The primary reason is the spread between high-quality 1-4 family and multifamily loans (approximately +150 to +300 bps) and HIFS’ consistently low cost of bank operations (expenses plus funding as a percentage of assets). Scale should only make that exercise more easily repeatable in more diverse economic outcomes than they were previously prepared for. The most easily visible example of HIFS advantage is their 15% return on equity in 2018, despite a flat yield curve like 2007 and lower nominal rates (the resulting lowering NIM offsets the higher provisioning in 2007). While I suspect returns on equity will fall some if the present yield curve persists, HIFS is capable of making the best of the challenging bank environment.

However, HIFS P/B multiple is near an all-time high and continued outperformance is a necessity at HIFS current valuation since at 1.8x P/B, HIFS is unlikely to benefit from further multiple expansion. As a result, the possibility of more than 20% returns over my holding period is quite limited and the possibility of negative returns over a short-term period is greater than I’d like with such limited upside. If HIFS trades closer to 1.5x P/B, I would feel more comfortable going long, regardless of HIFS earnings at that time (assuming there was no major change in loan underwriting quality). Note, I am only trying to describe my basic thought process around owning HIFS for a short-term and/or long-term period. I am not recommending any reader go long or short HIFS or any other security. I’m not your advisor.

I suspect that over the next year or two, HIFS annual meetings will become more popular as investors realized that HIFS is what investors generally perceive Markel Corporation (MKL) and GEICO to be or what a WEB-run bank may have looked like. Not withstanding the above, for truly long-term investors, HIFS is one of the best financial service companies to invest in.

Risk Factors to be Aware of:

Despite the laudations above, HIFS management is not perfect. I will say, in my experience at the annual meeting watching HIFS management interact with staff, attendees, employees, and other senior management, I came away impressed. However, I fully intend to question management’s judgement, when warranted.

An example of some risks is the structure of the BOD. Given the relationships of the individuals, it would be difficult for even independent members to object to any plans or strategy made by current management. Further, one board member is the daughter of the CEO and does not have banking experience. Bank management and directors takes reasonable compensation and rarely issues stock to themselves. This behavior supports a limited concern for these risks, though they are worth watching.

Another risk factor is the bank’s concentration in Boston- and Washington D.C.-area multifamily and apartment loans. This asset class trades at low cap rates in these geographical locations. Further, benchmark rates are generally near historical lows. An increase in yield/rates without a commensurate increase in rent inflation could cause many loans to fall in to default. The current CEO has proven an ability to oversee quality loan origination throughout cycles but the current COO and [likely] future CEO has yet to prove this ability.

Thanks for the blog post. Have you watched the video from the annual meeting? https://www.youtube.com/watch?v=flmR-LNtwbs&feature=youtu.be

LikeLike

Thanks for the very interesting analysis on HIFS. One of my concerns is that the current CEO is very advanced in age, and his son, the current COO, doesn’t seem to really fit the same mold. Based on his background, it looks like he’s more of a political policy wonk and just came into the family business when he realized there was more money in it. The father, of course, had a background as a real estate lawyer which very much fits in with the niche HIFS is in. I suppose the son could learn his father’s ways and rise to the challenge, but I’m afraid he might just be an average guy who won the ovarian lottery.

On another note, I’m curious, why do you say “infamous” in regards to OZK?

LikeLike

I don’t like posting about management outside generalities when I write up companies. I don’t know them on a day-to-day personal level.

From a review of the financial statements, company events, and the son’s individual contributions to the company, I think it’s safe to guess shareholders will ultimately be happy with him at the helm. I think if you dig deeper into the son’s CV you might come to a different opinion regarding the experience to run a bank.

I think it’s fair to say that OZK is relatively more promotional and has a reputation of aggressive underwriting.

LikeLike

Nice writeup. Are you at all concerned about rising sea levels? It looks like they have 2 branches on small islands – Nantucket and Hull – and rest are coastal… Is this a risk they are actively trying to mitigate?

LikeLike