First, some housecleaning. I noticed that the links in my last article open in the same tab instead of creating a new one. That should be addressed in this article and going forward. In general, if you happen to notice any issues related to my work or the formatting just let me know. Now on to the show.

In honor of Berkshire’s recent annual meeting (and due to the fact that it’s taking me too long to finish other planned write-ups and I don’t want dead-air on this blog), I propose an old-fashioned, Ben Graham-style investment. While it looks like a stump, I think this cigar butt is fairly dry and only half-finished. A decent-enough puff is still to be had.

Corporate History:

The history of ESCC is quite interesting and completely irrelevant to an investment in the company today. You aren’t missing anything if you skip this section.

ESCC was founded in 1968 by David Evans and Ivan Sutherland.

David had a background in EE and a PhD in physics prior to working on computers at Bendix in the 1950’s. He took this background and began working on Project Genie at Berkeley in the 1960’s, which was sponsored by DARPA. Also working on the project was the eminent Ivan Sutherland.

Ivan had a BS, MS and PhD in EE, with the latter coming from MIT. His doctoral thesis was the invention of the Sketchpad drawing application in the 1960’s, supervised by Claude Shannon, which later won him the Turing Award. He then went to the NSA and became the head of DARPA. Following Project Genie, Evans convinced Sutherland to move out to Utah and start a computer graphics firm.

In the 1970’s and 1980’s, ESCC made a name for themselves by inventing top-of-the-line flight simulators for military and commercial applications. They invented a line of graphics workstations known as the E&S Picture System, which was ultimately used to do the CGI in the original Star Wars.

By the 1980’s, ESCC starts to work on the core of their remaining business, planetarium projection systems and content! However, in the 1990’s, the firm starts to struggle and spins-off its molecular compound manipulation software and its CAD/CAM software. In 2006, ESCC sold their simulator business to Rockwell Collins (now part of UTX). All that’s left today is the planetarium projector business.

A longer history of ESCC can be found here if you are so interested.

ESCC Business Description:

According to ESCC, the company focuses primarily on digital planetariums and digital cinemas worldwide. ESCC offers Digistar, the world’s leading digital planetarium system, fulldome programs and production services, giant screen films formatted for fulldome theaters, premium-quality projection domes and theater design services.

According to ESCC’s 2017 Form 10-K (p.4):

We continue to maintain a significant share of the overall planetarium and full dome digital theater market. We estimate that the size of the market for digital planetarium systems is approximately $65 million annually and varies, of which our market share has ranged from 35% to 70% depending on the specific market size and time period.

There’s not much more to say. ESCC sells both hardware and licenses shows to planetariums (similar to the razor-and-blade model). ESCC has only reported licensing revenue for 1 year, which makes it impossible to do any analysis on. I may be underestimating ESCC’s business, but I will ignore all top-line breakouts for this post.

Just know that the breakout exists and you may disagree with this simplifying assumption.

ESCC Ownership:

Worth noting is that ESCC has NOL Carryforwards (“NOLs”) of $35.5 million. With NOLs comes restrictions on ownership changes.

Further reducing the chances of ESCC ever being acquired or taken private is the fact that the two largest shareholders: (1) Stuart Sternberg [owner of the Tampa Bay Rays] (~10.2% stake); and (2) Peter R. Kellogg [whose family made their money at KBR oil company, not the cereal] (~36.1% stake). Both owners and company executives have purchased at the end of each recent fiscal year, but generally insignificant amounts. Relative to their total wealth, the Stuart and Peter’s ESCC stakes are trivial.

This is a long way of saying that I will assume a trivial tax rate (2.5%) in to perpetuity and shareholders of ESCC will likely only do as well as the company does. There is no buyout, liquidation, or other financial engineering to save us from our mistakes here.

Analysis of Financials:

I know what you’re thinking.

“This is a tech company with world-class IP and a stranglehold on their niche market, it must be selling for more than 15x EBITDA!”

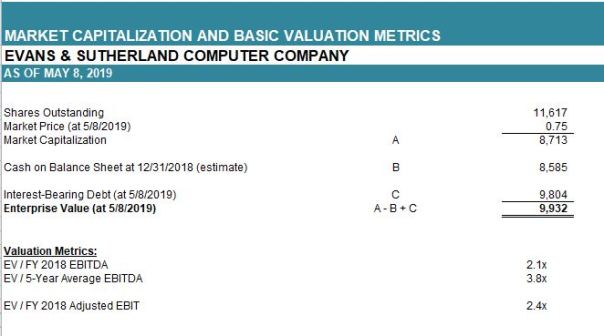

You are in luck, reader. You can purchase this storied company for the low, low price of 2.1x TTM EBITDA or 2.4x TTM EBIT.

There must be a catch, and there is.

- ESCC’s backlog is down precipitously and a review of the historical relationship between backlog and future revenue is worth exploring.

- Since ESCC’s backlog is down, is there still value if ESCC is operating at break-even or losing money in the short-run?

- ESCC has historically lost money. What, if anything, is different?

- What is the upside/catalyst or why will anyone purchase this from you at fair value?

Let’s review some numbers.

A summary of ESCC, as of 5/8/2019.

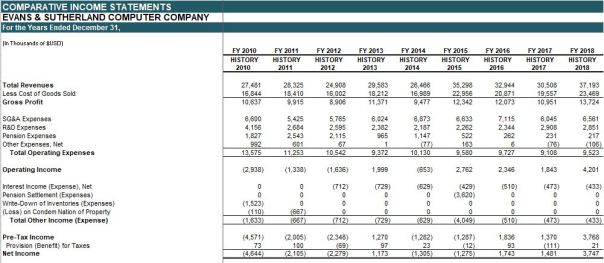

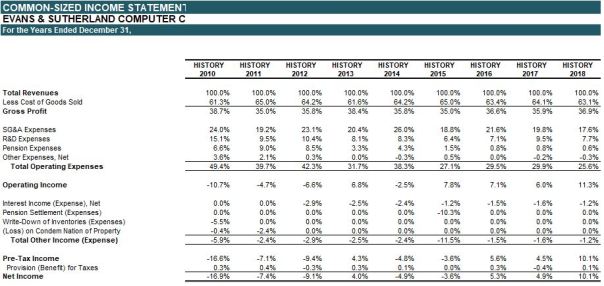

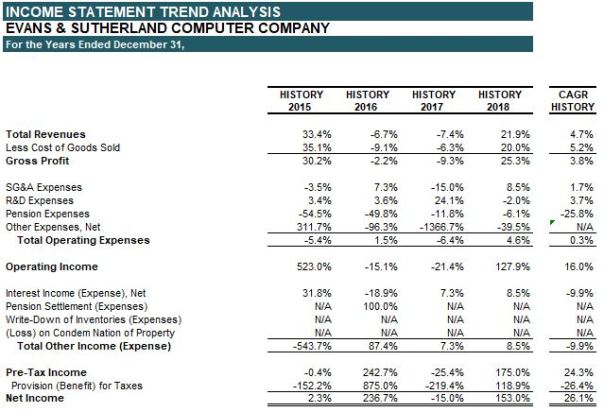

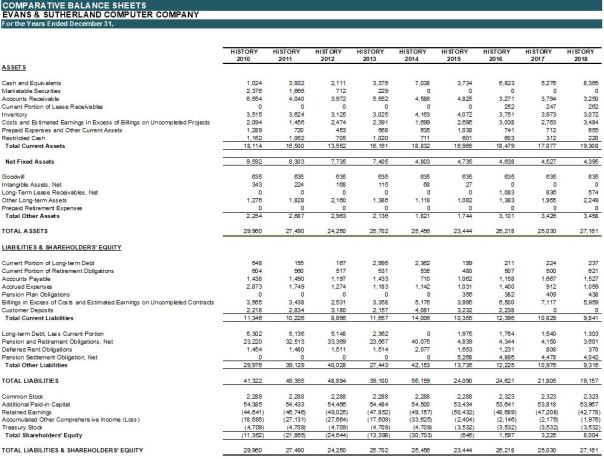

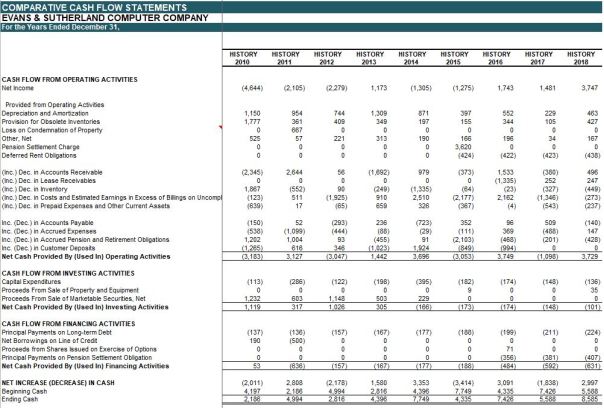

An overview of the (1) Income Statement; (2) Balance Sheet; (3) Cash Flow Statement; (4) Other Metrics; and (5) a Summary of EBITDA and FCF.

It is worth pointing out to readers that the FCFF summary implicitly adjusts back the $3.6 million loss due to the Pension Settlement in 2015. I think that is a reasonable adjustment (since it is truly one-time), BUT it also makes ESCC look more stable than they actually reported. This may be the correct view (I tend to think it’s a more accurate view), though you can decide for yourself.

A further adjustment to operating expense pension expenses was made to create a pro forma history that reflects the current variable and fixed pension expenses, based on that 2015 settlement. The as-adjusted FCFF suggests that a future decline in ESCC’s revenue may not be as destructive to FCFF going forward as it was in the past.

With that said, we are left with the elephant in the room, Backlog, and what it portends for the future.

Backlog vs. Forward Revenue Analysis:

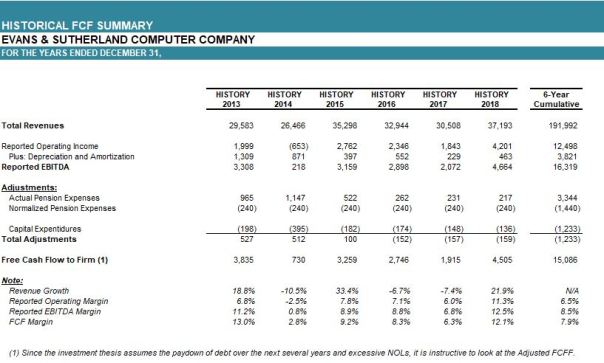

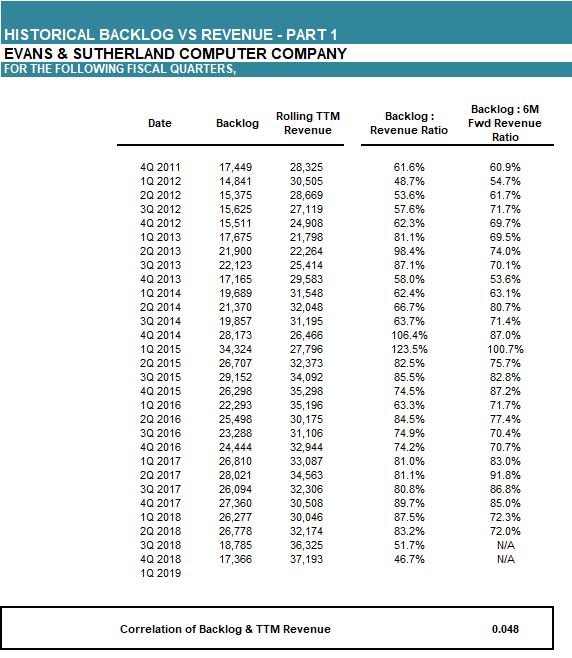

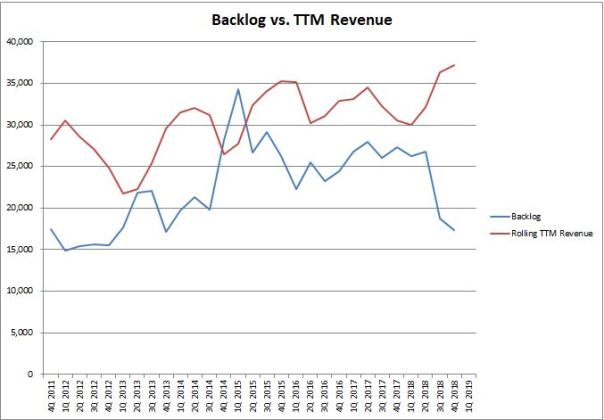

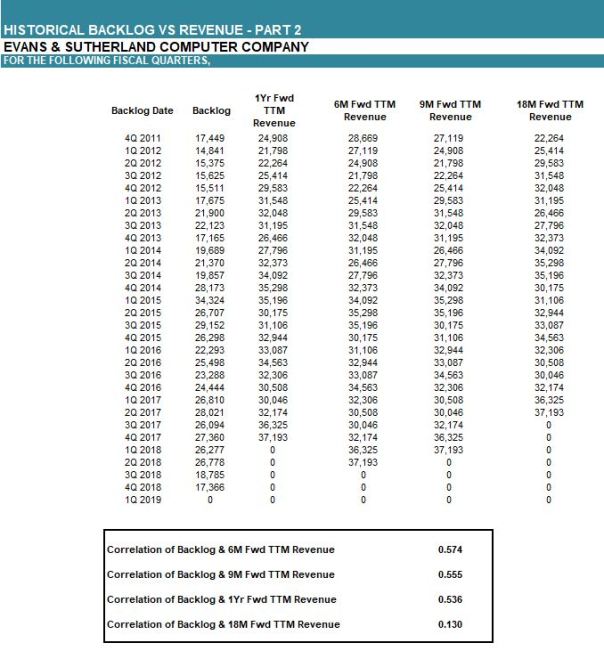

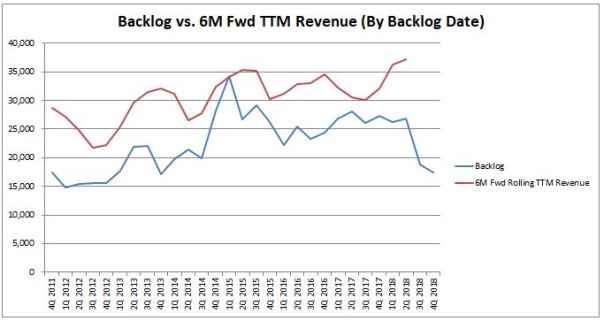

The following slides are a summary of a five-year analysis of ESCC’s backlog vs. future revenue analysis. In summary, backlog is loosely correlated to 6 month, 9 month, and 12 month forward TTM revenue, with an R^2 range of 0.536 to 0.574. Backlog is surprisingly not as correlated with future TTM revenue as I expected prior to the analysis.

However, that is not to say that there is no relationship between backlog and forward revenue. The current decline in backlog and the nature of the current backlog (heavily weighted to 2019 deliveries) suggests ESCC’s revenue will experience a sharp decline in the next 3-9 months. The last time ESCC’s backlog was below $20 million, the global financial crisis (“GFC”) was starting and revenue declined from more than $37 million to roughly $25 million. Then it took ESCC 7 years to recover to pre-GFC revenue.

I believe the above, combined with a review of ESCC’s common-sized income statements, suggests that ESCC’s revenue could fall to the $25 million to $30 million range. with decreased gross margins. This estimate is based on the assumption that backlog remains in the range of $15 million to $20 million range for multiple years. If backlog furthers declines then ESCC’s stock price will sharply decline and they may even be challenged as a going-concern. If backlog stabilized above $20 million or returns to the $25 million to $30 million range then an investment in ESCC will do quite well. It is that simple.

There is only one sentence in ESCC’s 1Q 2019 10-Q filing that will matter.

ESCC Valuation:

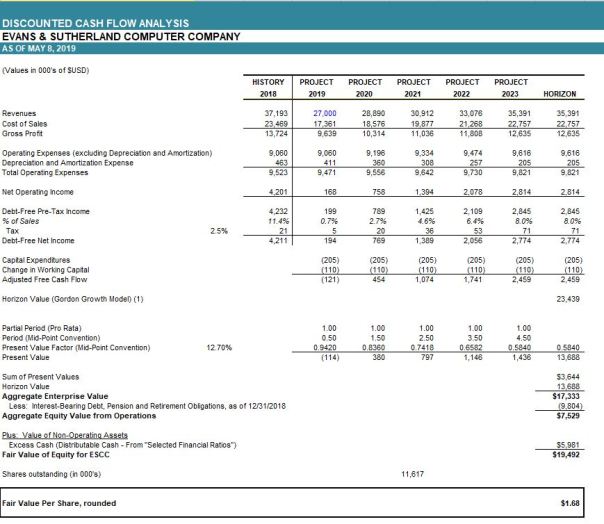

For ESCC’s DCF-based valuation, I will try to present a base case that assumes revenue falls to $27 million immediately and takes approximately 4 years to recover. I believe these are reasonable assumptions based on the above analysis. Simply put, my analysis suggests revenue will decline by 25% – 30% in the near-term and take multiple years to recover, so what is ESCC worth? Am I being rewarded for the uncertainty or risk that I’m absorbing?

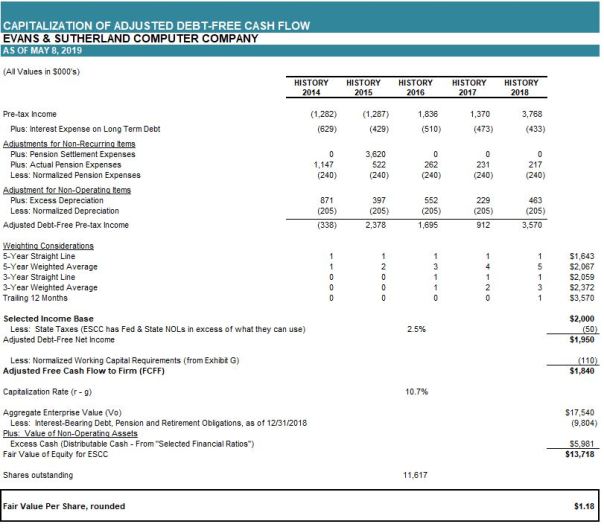

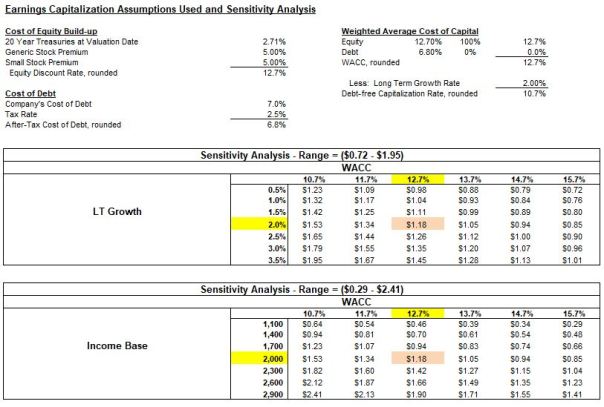

For ESCC’s earnings capitalization-based valuation, I will look at ESCC’s adjusted FCFF and look to the sensitivity analysis to determine what the margin of safety is. Basically, we are trying to find out what does ESCC’s current price imply about the market’s long-run expectations and is it reasonable to think they can outperform those expectations? If they do outperform, what is our reward?

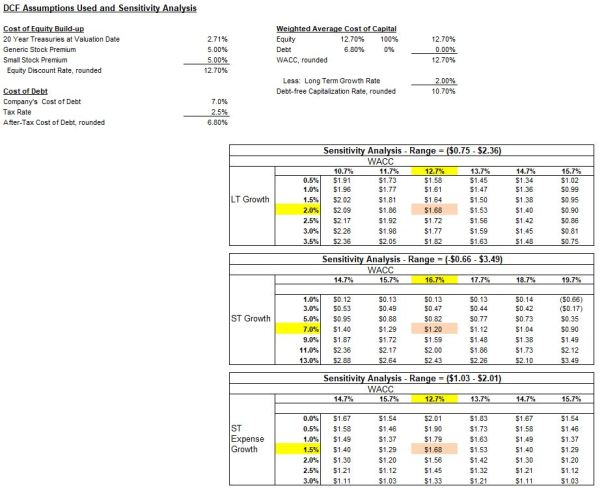

Additional DCF Modeling Assumptions:

- Gross Margins = 35.7%

- ST Revenue Growth Rate = 7%

- LT Revenue Growth Rate = 2%

- ST Expense Growth Rate = 1.5% (based on historical I/S review)

- D&A steps down to average CapEx of $205k per year

Additional Earnings Capitalization Assumptions:

- I assume additional working capital needs (ex-Distributable Cash) is roughly $110k per year, escalating at the long-term growth rate (2%) used above. It’s not that interesting and easily replicable by yourself to see how I got there so I won’t show my work for that assumption.

- The other assumptions are obvious.

Before moving to the conclusion, it should be obvious that negative valuations per share suggest that ESCC is worthless in those scenarios. In many of those situations, it is likely that a more complex (and probably not time-worthy) analysis is required. ESCC is not necessarily worth $0 in each of those scenarios (much like ESCC cannot growth revenue above $50 million or in the near-future due to that being implausible relative to the total available market (“TAM”) of the planetarium projector industry).

Conclusion:

It goes without saying that I think ESCC is an interesting investment opportunity at the moment. The investment float is no more than $4 million and liquidity is measured in $10,000’s per day. Many readers will not able to invest even if they would like to. Further, it is not certain that there will be liquidity when you want to sell or, more importantly, that there will be liquidity if ESCC’s operations turn south.

After ESCC reports an update to its backlog, I might be able to comment more. For the time being, ESCC is a high risk investment. The results of this investment will likely be due to luck. I am just trying to figure out if this is a profitable bet or not.

I am long ESCC at this time but readers should be particularly careful with this post since the market cap is so small and liquidity is so low.

Great blog post. Backlog decreased to $15,128. Thoughts? Also, you might have noted this but they do own some real estate at a subsidiary in Pennsylvania that could be worth arisen $4 million which could provide some liquidity if it gets really tough

LikeLike

I appreciate it SK.

I think backlog was somewhat expected. I was hoping they’d be at $7m/Q in orders, but I had no basis for that other than hopes and dreams. At least they added $5m+ in orders in the quarter vs the ~$1m/Q recently. A little progress.

Judging by history, I think they offer some discount and/or expedited setup and delivery to customers to push sales near-term. Strong dollar is somewhat hurting international orders. I would imagine backlog remains under $20m throughout 2019 before a push upwards. I still need to reach out to management just to hear what they have to say on the subject. Domes have an average life of 20 years so we should be entering the first true replacement cycle in the next few years.

Good point and I probably should have at least noted why I excluded the PA RE in other assets. The RE definitely provides downside protection to ESCC if the debt becomes unmanageable, which itself seems a ways away. As debt is paid down, I would add the excess value of the RE to ESCC (spread between RE cap rate and cap rate on ESCC cash flows). For now, it helped me get comfortable with the WACC I used. I should have done a better job explaining the logic in this spot.

Some other data that I couldn’t find a way to include in the writeup but you might find useful:

https://www.lochnessproductions.com/reference/attendance/attendance.html

https://www.lochnessproductions.com/reference/attendance/more_attend.html

LikeLike

Any thoughts on the most recent quarter?

LikeLike

I thought they would be at a sales level that kept backlog steady by now. I think it’s still a decent bet but I’d really like to see a good backlog stuffing quarter soon.

LikeLike

Following

LikeLike